UPA Financing from A to Z

What principles is the financing based on?

The UPA is the association legally accredited under the Farm Producers ActThis link will open in a new window to represent all Quebec farmers, regardless of their business size, production sector, or region. Its duty is to defend their interests wherever they are at issue. The UPA is financed by and for farmers, meaning that its union activities are solely funded by farmers—an essential feature that gives the organization the freedom to act on their behalf.

Also, as is true for all union structures in Quebec, the assessment used to finance the UPA’s activities is mandatory, given that all farmers benefit from its actions (under the Rand formula); this is a matter of fairness. Membership in the UPA is nevertheless voluntary.

Each financing plan is developed with the following principles in mind :

- Financing by and for farmers

- Frugality and respect for farmers’ ability to pay

- Fairness among farmers and among UPA bodies

- Balance in financing from assessments and from contributions

- Passing on financial wealth between generations

For many years, approximately 92 percent of Quebec farmers have voluntarily become UPA members.

How does it work?

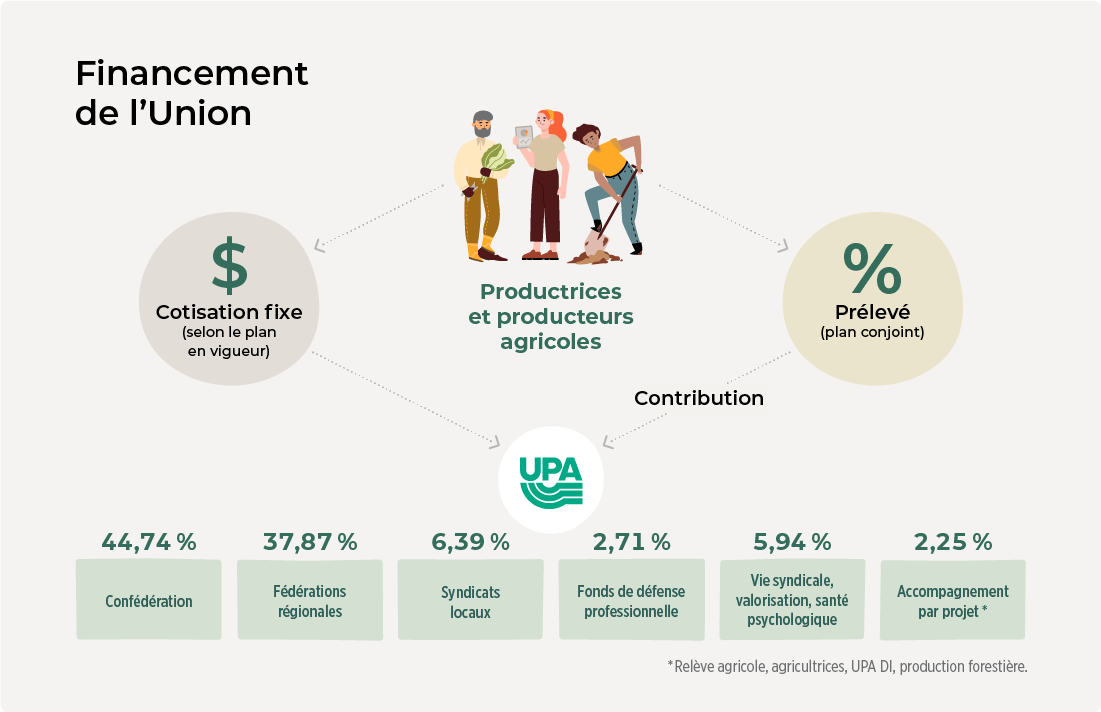

The UPA’s financing comes from two sources: a fixed assessment, which is paid by all farm producers, and a variable contribution, which is paid by specialized federations and syndicates out of the money they collect from producers covered by joint plans. The assessments may be single or double depending on the business’s legal status and the number of voting rights (one or two).

Money from these two sources is distributed among the different bodies of the organization (local syndicates, regional federations, and the confederation) according to the needs as defined in the current financial plan.

What’s the difference between assessments and contributions?

The annual ASSESSMENT is a fixed amount paid by all agricultural producers recognized as such under the Farm Producers ActThis link will open in a new window. Total assessments paid to the UPA account for about 60 percent of its financing.

The CONTRIBUTION is a fraction of the fees paid by producers to finance the activities and administration of a joint marketing plan This link will open in a new window; it is also known as a deduction. It is collected by the federation or specialized syndicate in charge of administering the joint plan.

The contribution is based on production volume, which ensures greater proportionality in the financing effort required of each farmer. Total contributions account for about 40 percent of the UPA’s financing.

The total amount of deductions collected by a specialized group differs from sector to sector and is based on the type of organization and on the collective services provided through a joint plan (sales agency activities, product transportation, quality control, research and promotion, etc.).

Note that some production sectors do not have a joint marketing plan. In this case, producers do not pay any contribution.

Why do some businesses pay double assessments?

As mentioned above, producers must pay a single or double assessment depending on their business category. Thus, for farmers operating within a single business, the regulations recognize a maximum of two voting rights at the syndicate AGM, and thus the business is required to pay the equivalent of two assessments.

How are the UPA’s financing terms and financial needs determined?

Generally speaking, every half-decade, a five-year plan is adopted at the UPA’s annual general congress. Roughly 18 months before the adoption of the plan, a committee with representation from all UPA bodies (local syndicates, regional federations, specialized groups, and the confederation) is formed. The committee ascertains the organization’s financial health and evaluates its needs. Coming out of this process, a first round of consultation with the boards of the affiliate groups is conducted. One of the purposes of this round is to determine one or more financing scenarios to be brought to producers during a consultation held in the months leading up to the general congress. Any final decisions regarding financing are made democratically by all farmers in attendance at the general congress.

What does the current financing plan say about increases?

The current financing plan (2025–2029) was adopted in December 2024 by the delegates at the general congress. See below for some information about the five-year financing scenario:

| Assessment increase on January 1st | Annual Assessment | Contribution on August 1st | |

|---|---|---|---|

| 2025 | +60$ | 466$ | +4% |

| 2026 | +10$ | 476$ | +4% |

| 2027 | +10$ | 486$ | +4% |

| 2028 | +10$ | 496$ | +4% |

| 2029 | +5$ | 501$ | +4% |

Note that, in the resolution accompanying the plan, delegates also requested that the UPA do the following :

- Implement, starting in 2027, a new regime for assessments aimed at achieving greater fairness with respect to both the size of farm businesses and whether or not they pay contributions under joint plans.

Credit for UPA Dues Program 2025 (revenues of $25,000 of less)

To know more about the programWhat is the money collected from producers used for?

Maintaining farmers’ power relative to that of other interests

Founded in 1924, the UPA originally grew out of Quebec farmers’ will to join forces and rise to challenges that would be hard to tackle individually, and to increase their power relative to government bodies and other links in the agri-food chain. In an increasingly globalized and financialized world, in which those who sell inputs and those who buy agricultural products are becoming more concentrated, maintaining this power is more important than ever for local family farming.

Sustaining Quebec agriculture

Through its collective actions, the UPA helps develop and protect Quebec agriculture—with positive results to show for it. Based on statistics on the Canadian agricultural sector, the following can be said of Quebec farmers:

- They benefit from legislative support tools that are unique in Canada and receive more generous direct payments from governments:

- Quebec agriculture weathers crises more successfully.

- The portion of direct payments paid by the federal and provincial governments in Quebec (i.e., direct payment per unit of production value) is higher on average than in Ontario and the rest of Canada.

- They generate higher net income:

- While production volumes are higher in Ontario, Quebec farms generated higher net incomes in almost every one of the last 20 years.

- Net farm incomes in Quebec are also much more stable than in Ontario.

- They include more young farmers per capita and go out of business at lower rates.

Representing, defending, promoting, and addressing producers’ needs

The UPA does the following:

- Maintains a presence in all agricultural administrative regions and MRCs in Quebec; its representatives collaborate with sector stakeholders to speak up for the perspectives of the farmers they represent

- Has the capacity, by virtue of its position, to speak on behalf of farmers and their expectations in various provincial, national, and international platforms

- Promptly intervenes in crisis situations or when problems arise (for example, in November 2019, the UPA urgently called for the government to fix the propane supply crisis; the media coverage demonstrated how significant the problem was for farm businesses and resulted in a faster resolution to the crisis)

- Conducts analyses on many regulatory and legislative drafts affecting farm businesses taking into account details about the sector (environment, property taxes, land use planning, regional development, energy development, etc.)

- Provides farmers with up-to-date services in all regions (agricultural employment centres, farm accounting and tax services, land use planning, marketing, “road workers,” legal services, etc.)

- Actively works to protect land and farming activities; to this end, it issues notices to the Commission de protection du territoire agricole every time requests to use farmland for non-agricultural purposes are proposed

- Develops and coordinates campaigns to publicize and promote the farming profession, as well as to educate the public about the role local agriculture plays in the socioeconomic development of Quebec and its regions (through the Journée Portes ouvertes sur les fermes du Québec open house event and through advertising campaigns on the importance of buying locally, agri-environmental practices, the work of local farmers, etc.).

To find out more, we invite you to read the following document:

To know more :