A long-awaited reform

In recent years, the UPA has received a number of requests from producers to make the dues system more equitable for all farm businesses.

The goal is twofold: to change the existing system so that each business pays assessments based on its gross farm income, and to ensure better balance between production types that pay contributions to the UPA through joint plans This link will open in a new window and those that do not.

A legislative amendment This link will open in a new window passed in November 2023 enables the UPA to make these changes, which will apply to all farm producers in Quebec starting in January 2027. Producers have been involved in the proposed reform through multiple consultations and a democratic process.

Read more about the current dues system This link will open in a new window

The new dues system

With a view to ensuring equity, the proposed system—which was passed by the General Congress on December 3, 2025—includes two important changes to the current system. Provided they receive approval from the Régie des marchés agricoles et alimentaires du Québec, they will take effect on January 1, 2027.

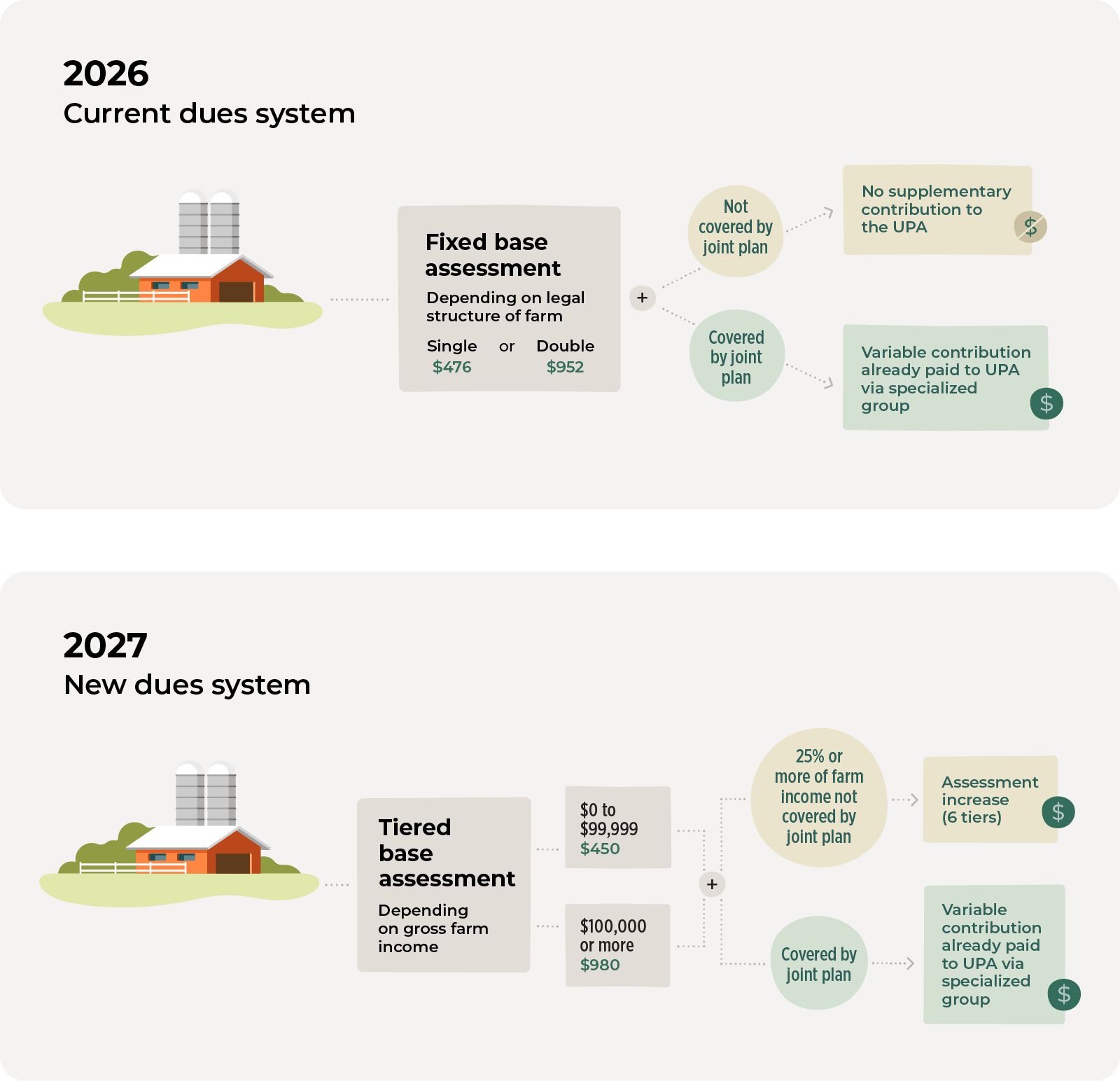

1. Tiered base assessment

The current system of single and double assessments, which are charged depending on the legal status of each farm business, will be eliminated. Starting in 2027, a new base assessment amount will apply; this amount will depend on which tier the producer falls into based on gross farm income.

Prospective scenario

| Tier | Gross farm income | Base assessment | ||

|---|---|---|---|---|

| 1 | $0 to $99 999 | $450 | ||

| 2 | $100 000 or more | $980 | ||

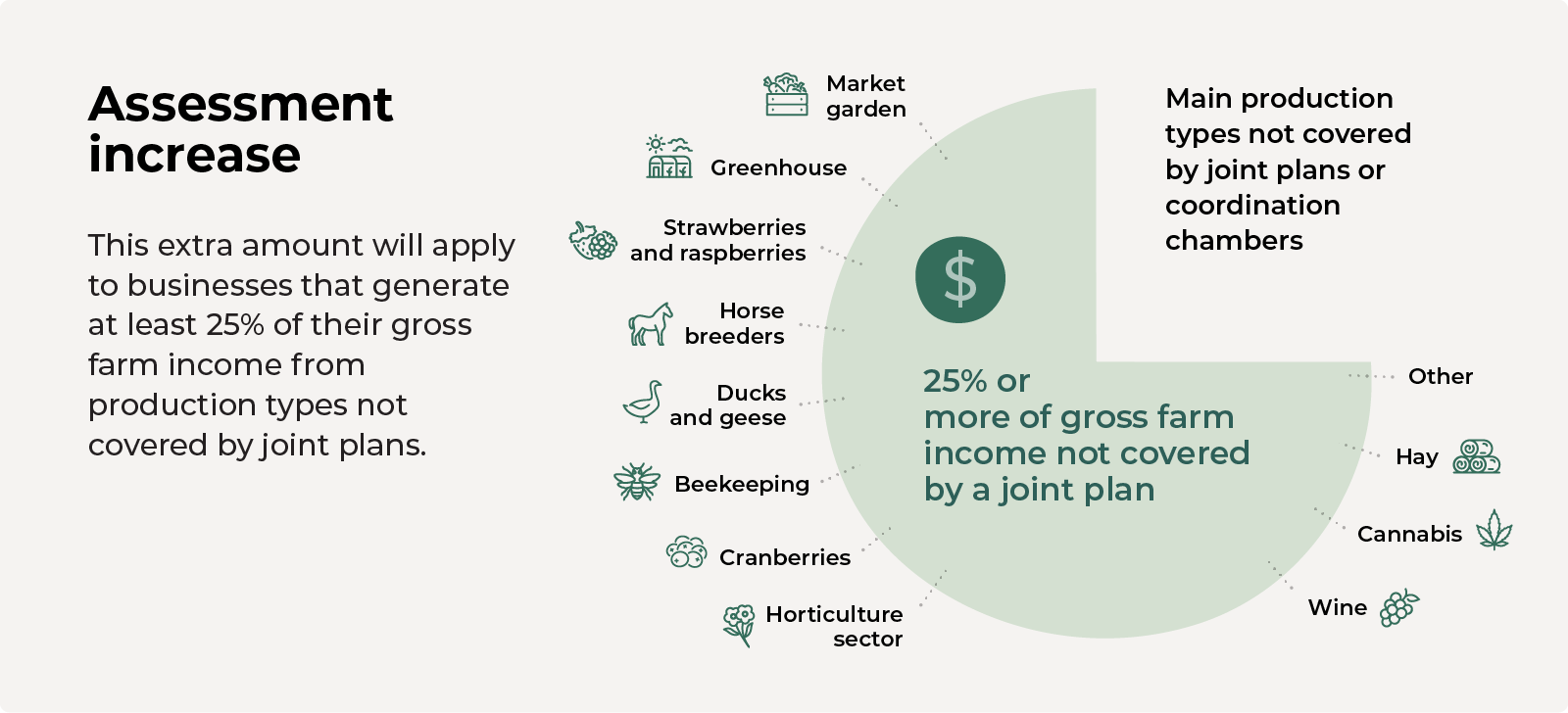

2. Assessment increase

An assessment increase (commonly referred to as a supplementary assessment) will also apply in certain cases to make financing more equitable between production types that pay contributions to the UPA through joint plans and those that do not.

Will be required to pay this amount : only businesses in which at least 25% of gross farm income is generated by products not subject to contributions (83 KB) to the UPA (PNACs) – products not covered by joint plans.

Prospective scenario

| Tier | Gross farm income from PNACs | Assessment increase (“supplementary assessment”) | ||

|---|---|---|---|---|

| 1 | $0 to $99,999 | $50 | ||

| 2 | $100 000 to $249,999 | $175 | ||

| 3 | $250 000 to $499,999 | $375 | ||

| 4 | $500 000 to $999,999 | $750 | ||

| 5 | $1 million to $1,999,999 | $1,500 | ||

| 6 | $2 millions or more | $2,500 | ||

Production types covered by joint plans already pay this portion of the UPA’s financingThis link will open in a new window through contributions collected by their specialized federations and syndicates.

- Les Producteurs de lait du Québec (dairy)

- Fédération des producteurs forestiers du Québec (forestry)

- Fédération des producteurs d’œufs du Québec (eggs)

- Éleveurs de volailles du Québec (poultry)

- Les Producteurs de pommes du Québec (apples)

- Les Producteurs de pommes de terre du Québec (potatoes)

- Producteurs de légumes de transformation du Québec (processing vegetables)

- Les Éleveurs de porcs du Québec (pork)

- Producteurs de grains du Québec (grains)

- Les Éleveurs d’ovins du Québec (sheep)

- Les producteurs de bleuets sauvages du Québec (wild blueberries)

- Les Producteurs de bovins du Québec (cattle)

- Producteurs et productrices acéricoles du Québec (maple products)

- Les Producteurs d’œufs d’incubation du Québec (hatching eggs)

- Syndicat des producteurs de lapins du Québec (rabbits)

- Producteurs de lait de chèvre du Québec (goat milk)

Gross farm income

The definition of gross farm income is primarily based on the definitions of producer and agricultural product in the Farm Producers Act.

Gross farm income is money derived from marketing agricultural products (except wood products). This includes any income producers earn from livestock, as well as any replacement, supplementary, or additional income associated with a specific agricultural product.

| INCLUDED in gross farm income | EXCLUDED from gross farm income |

|---|---|

|

|

Annual declaration

To determine the dollar amount for the new assessment to be paid in 2027, all producers will be required to complete an annual declaration. This declaration will confirm the appropriate assessment tier for their gross farm income. If all goes as planned, the declaration reflecting the financial year ending 2025 will need to be completed between March and June 2026 in preparation for the new system to take effect in 2027.

All farm producers will receive the information they need to complete their declaration during the winter of 2026. The declaration will be simple and straightforward to complete.

Next steps (2026 and 2027)

- January 2026: The draft regulation, which makes the assessment tier declaration mandatory, is sent to the Régie des marchés agricoles et alimentaires du Québec (RMAAQ) for approval.

- February 2026: Farm producers receive their notice of dues and pay under the existing system for 2026 ($476 for single assessments, $952 for double assessments).

- March to June 2026: All producers complete their mandatory assessment tier declaration in preparation for the 2027 assessment.

- February 2027: Farm producers receive their notice of dues for 2027, which is based on the assessment tier declaration submitted in 2026, and pay accordingly.

Questions about the new system?

See here for answers.

If you have any further questions,

please contact your local syndicate,

write to us at cotisations@upa.qc.ca,

or call the dues service

at 1-855-534-7120.

Since 1990, assessments charged to producers have been dictated by the legal structure of each farm business (sole proprietorship, partnership, trust, legal person, etc.). The parameters that determine the assessment amount are outdated and no longer reflect the reality of farming today.

Over the last 10 years, producers have on multiple occasions asked the UPA for the following:

- Lower assessments for small businesses, which often have high costs relative to income, especially in the case of multiple-owner farms

- More equitable financing through a new mechanism to allow for an assessment increase for producers not covered by joint plans

In response to these requests, numerous advance consultations were held. The purpose of these was to see how willing producers were to change the system. November 2023 saw the passing of Bill 28, which amends the Farm Producers Act. As a result, the UPA is now allowed to set new parameters for determining assessment amounts.

Following a rigorous consultation process with members in 2025, a resolution was passed at the General Congress in December that lays the groundwork for a new and more equitable dues system.

Increasing the budget is not the goal of the new dues system. The system is designed to address financing needs that have already been identified. Under the new proposed system, the amount paid by each farm business will change in order to ensure greater equity.

Yes. The Règlement sur les contributions des fédérations et des syndicats spécialisés à l’Union des producteurs agricoles (Regulation respecting the contributions of specialized federations and syndicates of the Union des producteurs agricoles) continues to apply. The regulation already allows for a certain amount of equity between producers, since contributions paid to the UPA by the specialized federations and syndicates that administer the joint plans already account for the volume of agricultural products marketed.

Yes. If all goes as planned, the new dues system will only take effect on January 1, 2027. This means producers must pay the bill they receive in February 2026 for the current year’s dues.

However, assuming the RMAAQ grants its approval, starting in March 2026, all farm producers in Quebec will be required to complete an assessment tier declaration for the financial year ending 2025. This will allow the UPA to determine the assessment amount they need to pay in 2027.

Yes. All farm producers in Quebec will be required to complete an annual declaration in 2026 so that the UPA can determine the assessment amount they need to pay the following year.

You will be able to complete your assessment tier declaration online via a secure website, or by paper through the mail. You will also be able to contact our dues service for support.

All the information you need will be available on our website. You will also receive the information by mail and email in early months of 2026.

The more tiers there are, the more complex it becomes to manage them. This could harm the integrity of the system and the UPA’s financial stability. Furthermore, it is desirable to limit the impact of the change on most farm businesses by ensuring future assessment amounts are as close as possible to current ones. The number of tiers could change in the future.

Since 2021, numerous consultations with board members and producers took place to gather opinions about proposed changes to the dues system.

- Different scenarios were generated to set the assessment tiers in a manner that was appropriate to the overall portrait of farm businesses and aligned with the budget established in the UPA’s financing plan.

- In parallel to these consultations, 2024 saw the adoption of the 2025–2029 financing plan. The plan sets out the five-year budget for the organization and specifies how much money needs to be collected through assessments and contributions.

On September 3, 2025, the UPA General Council passed a resolution to consult producers regarding a new dues system. The system has two tiers for the base assessment. It has six tiers for the assessment increase, which is linked to income from products not subject to contributions (PNACs).

Assessment

The assessment is an amount of money that all producers pay to the UPA each year. Depending on their structure, certain farm businesses pay a double assessment. This is the case when multiple producers are grouped together within the same partnership[SI1] , for instance.

Contribution

The specialized federations and groups that administer joint marketing plans collect a certain amount of money each year from producers within their dedicated production type. This amount is based on each producer’s volume. A portion of this money is used to finance the joint plan itself; it varies based on the collective services delivered under each plan. The remaining portion of the money collected is the contribution paid directly to the UPA by the specialized federations and groups. In sectors not covered by joint plans, producers do not pay any contributions.

Since 1956, the Act respecting the marketing of agricultural, food and fish products has allowed producers to join forces and collectively organize the conditions for producing and marketing their products. This practice is known as collective marketing.

A joint plan is one of the forms collective marketing can take. It allows producers within the same sector to share costs and give themselves the tools they need to carry out their activities collectively. They may, for example, define quality standards, ensure optimal conditions for production, run shared research and innovation programs, launch promotion campaigns for their products, and/or provide buyers with a guaranteed supply.

The budget for the 2030–2034 financing plan will be established based on the recommendations of the medium- and long-term financing committee and broad-based consultations.

The definition we propose is as follows: gross farm income is money derived from marketing agricultural products (except wood products). This includes any income producers earn from livestock, as well as any replacement, supplementary, or additional income associated with a specific agricultural product.

| INCLUDED in gross farm income | EXCLUDED from gross farm income |

|---|---|

|

|

The definition of gross farm income is primarily based on the definitions of producer and agricultural product in the Farm Producers Act.

A portion of the UPA’s financing comes from contributions that producers pay to specialized federations and syndicates through joint plans. By contrast, producers operating in sectors with no joint plan do not pay any contributions.

The purpose of the assessment increase is to ensure more equitable financing among businesses. It does so by taking into account whether or not producers already pay contributions to the UPA through joint plans.